Employee benefits are a core function of human resources, and for good reason: A comprehensive employee benefits package can help keep current employees happy, and competitive perks can attract and retain top talent amidst a tight labor market.

But employee benefits are a complicated, messy space that can seem daunting: Between staying legally compliant and adjusting plans based on employee and employer needs, it’s enough to make your head spin. And don’t forget about the dreaded benefits election and enrollment process.

Luckily, we’ve got your essential guide to all things employee benefits, including the most popular offerings and key considerations for implementation.

What are employee benefits – and why are they important?

Put simply, employee benefits are additional perks or benefits beyond regular compensation and wages, such as health insurance, paid vacation days and retirement accounts.

While some employee benefits are required by law, others are voluntary. However, there’s an important caveat: Some voluntary employee benefits are considered “industry standard” and are expected to be offered by employers.

Beyond legally required employee benefits, employers choose to offer voluntary benefits because they play a crucial role in several areas of the employee experience, including recruitment, retention and engagement.

In a recent Care.com survey, HR professionals reported that the primary goal of their employee benefits program is:

- Increasing productivity (53%), and

- Attracting and retaining employees (49%).

Employees who are satisfied with their benefits can be more engaged and have higher satisfaction levels, and are 13% more likely to continue working for their current employer for three or more years, according to Qualtrics.

But satisfaction with employee benefits is at a 10-year low, according to Metlife, cementing the importance of choosing the right employee benefits for your workforce.

Types of employee benefits

There are many different types of employee benefits that span several areas, but they can be broken down into some core categories:

- Health and wellness benefits

- Financial benefits

- Time-off and leave benefits, and

- Work-life balance benefits.

Here are some of the most common employee benefits employers can offer.

Health and wellness benefits

Health and wellness benefits are an important part of any comprehensive employee benefits plan. These benefits support employees’ physical, mental and emotional health, ensuring that workers can bring their best, healthiest selves to work.

Some health benefits are mandated by state or federal law, while others are voluntary.

Health insurance options

Health insurance is a common fringe benefit – a form of non-monetary compensation offered to employees in addition to their salary. Health insurance helps employees access medical care and cover the cost of services like doctor visits, hospital stays and prescriptions.

Although there is no federal law that requires all employers to provide health insurance, it is mandated for certain employers under the Affordable Care Act (ACA). The ACA is a federal law that requires employers with 50 or more full-time employees to provide health insurance or risk a hefty penalty from the IRS.

There are various types of health insurance plans, including:

- Preferred Provider Organization (PPO): A PPO uses a network of providers – including doctors, specialists and hospitals – that offer services at a reduced rate. Although members don’t have to use in-network providers, providers that are out of network will be more expensive. PPOs also don’t require referrals and offer some out-of-network coverage.

- Health Maintenance Organization (HMO): An HMO plan requires members to choose their primary care physician (PCP) within their network and requires referrals to specialists. In-network services are typically covered, but members may need to pay out-of-pocket costs for providers outside of the network. HMOs may also cover preventive care like routine check-ups, vaccinations and screenings.

- High Deductible Health Plan (HDHP): As the name suggests, HDHPs have higher deductibles than other plans and higher out-of-pocket maximums, but have lower monthly premiums. They’re also required to cover certain preventive care services like vaccinations and screenings.

FSA/HSA

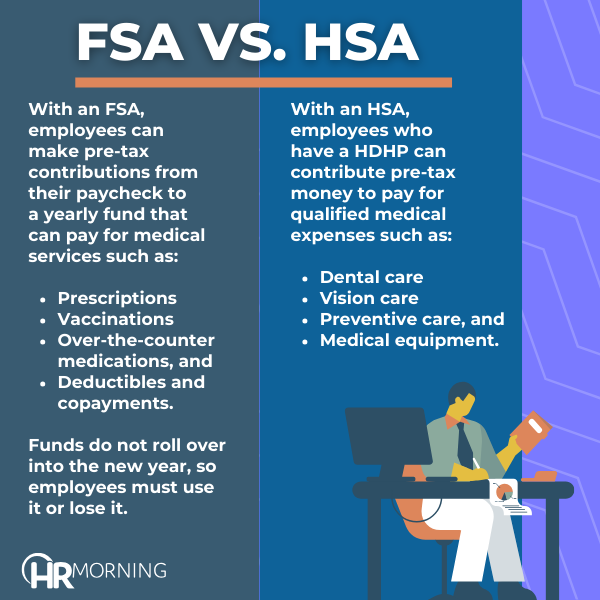

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) are both supplemental programs that are used alongside health plans, but they have some distinct differences.

There is no legal obligation to provide either an FSA or an HSA, and both are typically considered fringe benefits. For both HSAs and FSAs, employers can choose to contribute funds but aren’t required to do so.

With an FSA, employees can make pre-tax contributions from their paycheck to a yearly fund that can pay for medical services such as:

- Prescriptions

- Vaccinations

- Over-the-counter medications, and

- Deductibles and copayments.

Funds do not roll over into the new year, so employees must use it or lose it. With an HSA, employees who have an HDHP can contribute pre-tax money to pay for qualified medical expenses such as:

- Dental care

- Vision care

- Preventive care, and

- Medical equipment.

Unlike FSAs, funds in HSAs will roll over year-to-year, so employees can invest their HSA money over time and can take the money with them if they get another job. However, HSAs have yearly limits that are set by the IRS.

For 2023, limits are $3,850 for self-only coverage and $7,750 for family coverage.

Dental and vision care coverage

Dental and vision care coverage fall under the umbrella of health insurance. Employers may choose to contribute a portion of premium costs and some choose to cover the entire premium.

Dental insurance will typically cover care like check ups, cleanings, fillings, extractions and other common dental procedures. Benefit plans sometimes have annual maximums and waiting periods.

Vision insurance covers eye exams and vision care like glasses or contact lenses and may also include limits of service frequency and a set allowance for eyewear.

Wellness programs and initiatives

Wellness programs encompass any benefit or initiative designed to promote employee health and well-being. They aren’t legally required, but many employers choose to implement them to stay competitive and retain talent.

There are many different types of wellness programs. For example, some insurance providers have wellness initiatives as part of their insurance benefits, but employers can also implement programs independently.

Wellness programs can include offerings like:

- Gym memberships

- Health screenings

- Nutrition programs

- Wellness challenges

- Smoking cessation programs, and

- Health education.

Wellness programs can also include fringe benefits such as subsidized gym memberships, fitness equipment reimbursement, free or discounted healthy snacks, and subscriptions to wellness apps or online fitness programs.

Mental health support

Now more than ever, mental health support should be an essential part of any robust employee benefits plan.

Mental health support can include a range of benefits to support employee well-being, such as counseling services, employee assistance programs and access to additional mental health services. They may also include fringe benefits such as therapy subsidies, mental health app subscriptions or subsidies for other mental health support such as yoga or meditation classes.

Preventive care coverage

Preventive care is typically a component of health insurance plans. It includes any healthcare services or screenings that can prevent illness or catch any health issues early on.

This might include coverage for vaccinations and immunizations, yearly wellness check ups, and screenings for cancer or chronic conditions.

Offering preventive fringe benefits can also serve as an incentive for employees to stay on top of their health. Fringe benefits might include flu vaccination clinics, fitness subsidies such as fitness trackers or memberships, and health risk assessments.

Disability insurance options

Disability insurance is not legally mandated in the U.S.; however, the U.S. does have laws requiring some types of insurance such as workers’ compensation, which can benefit employees hurt on the job. Plus, some labor unions negotiate disability insurance as part of their contract.

There are two major types of disability insurance:

- Short-term disability (STD): This option covers injuries or disabilities that prevent an employee from working for a short time – typically up to six months – and replaces a percentage of the employee’s salary while they recover.

- Long-term disability (LTD): After an employee passes the STD time period, LTD insurance can kick in to cover benefits for a longer period of time, even up to retirement age. Employees still get a percentage of their salary, but it is typically at a lower rate than STD.

Employers can cover the premium in full, or they may cover a portion and take the rest using payroll deductions. Employers can also provide group disability insurance policies, which can make the coverage more affordable and sometimes more comprehensive. There are also tax implications depending on how much an employer contributes to premiums.

Life insurance options

Life insurance is an important fringe benefit that many companies offer. Life insurance pays out funds to an employee’s chosen beneficiaries in the event they pass away.

Coverage options depend on the plan. Employers often choose a basic group policy that pays a fixed amount, usually based on the employee’s salary, at no cost to the employee. Additional coverage may require the employee to pay a premium through payroll deductions.

Financial benefits

Retirement plans

Retirement plans are a critical part of a comprehensive employee benefits plan. In fact, one-third of employees and employers consider retirement and pension plans the most important benefit employers can offer, according to Forbes.

They allow the employee to invest a portion of their wages – as well as earn employer contributions – to plan for the future.

There are several different types of retirement plans with different perks and eligibility rules. The most common plans are:

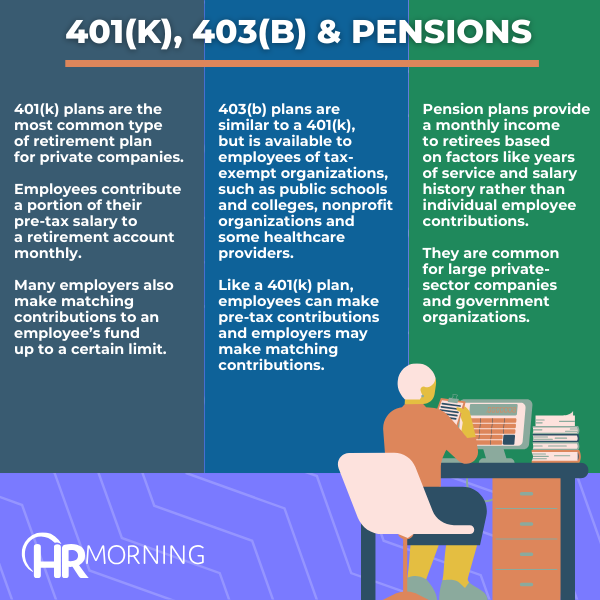

- 401(k): 401(k) plans are the most common type of retirement plan for private companies. Employees contribute a portion of their pre-tax salary to a retirement account monthly. Many employers also make matching contributions to an employee’s fund up to a certain limit. For 2024, there is a $23,000 annual contribution limit.

- 403(b): This plan is similar to a 401(k), but is available to employees of tax-exempt organizations, such as public schools and colleges, nonprofit organizations and some healthcare providers. Like a 401(k) plan, employees can make pre-tax contributions and employers may make matching contributions, and

- Pension: Pension plans provide a monthly income to retirees based on factors like years of service and salary history rather than individual employee contributions. They are common for large private-sector companies and government organizations.

Although retirement plans are not legally required, there are regulations for employers who choose to offer them.

Stock options and equity plans

Some companies offer stock or equity in the company as a way to retain employees. These fringe benefits can be part of a comprehensive compensation package and can help employees feel invested in the company and its success.

Here are some of the most popular options:

- Employee Stock Ownership Plans (ESOPs): In an ESOP, a company will contribute stock to an employee trust fund. Share allocation can depend on salary and tenure, and employees can sell shares back to the company when they leave or retire.

- Stock grants: Stock grants give employees a number of shares for free or at a discount. There is typically a vesting period where employees have to remain with the company for a certain duration to gain ownership over the shares. Once vested, employees can choose to sell, transfer or retain the shares.

- Employee stock purchase plans (ESPPs): In an ESPP, employees can purchase company stock at a discounted price – up to a 15% discount – through payroll deductions. They typically include offering periods for employees to enroll and accumulate funds, a look-back period to ensure employees get the best price and may include a holding period where employees are prohibited from selling shares.

Bonuses and profit-sharing mechanisms

Additional forms of compensation, such as bonuses or profit-sharing, are popular financial benefits for employers to attract and retain talent.

Bonuses provide additional monetary rewards for employees beyond their regular salary and benefits. Bonuses can be discretionary, based on factors like individual or company performance, or achievements. There are also non-discretionary bonuses – based on predetermined conditions – to incentivize employees.

Bonuses can be calculated based on a percentage of an employee’s salary or may be a fixed amount. They can also be distributed at random or at set points through the year, such as annually or quarterly.

On the other hand, profit-sharing involves distributing a portion of the company’s profits among employees based on the company’s financial performance. If the company’s profit exceeds a certain threshold, the company then shares a portion of that profit with eligible employees.

Profit allocation is typically based on individual performance, team performance or company-wide achievements, and eligibility can be based on factors like job position or tenure.

Student loan assistance programs

Student loan repayment assistance is a rising benefit that companies use to attract talent, especially younger generations, and stand out to job seekers in a competitive market.

Companies typically offer assistance in the form of financial assistance through monthly or annual contributions, or a one-time lump-sum. The benefit can be based on eligibility requirements or be open to all employees, and may have repayment contingencies if an employee leaves the company before fulfilling eligibility requirements.

As an added benefit, there are tax benefits to student loan assistance. In the U.S., up to $5,250 of assistance per employee per year can be tax-free.

Work-life balance benefits

Paid time off

Paid time off (PTO) is a common benefit that allows employees time off of work while still getting paid their salary. Although not legally required in the U.S., other countries such as Austria and Finland have minimum PTO requirements.

Unlike other types of leave – such as bereavement leave or sick days – PTO can be used at any time for any reason, within certain limits. For example, retail companies may have “blackout dates,” such as major holidays, that employees need to be available for, and most employers require employees to give ample notice before taking time off.

But not all PTO options are the same. There are two types of PTO that employers can implement:

- Set PTO: Set PTO provides employees with a predetermined number of days off. Employees typically accrue days periodically, such as annually, which can encourage retention. Employers may have a “use it or lose it” policy where PTO resets in the new year, or PTO days can roll over into the new year. Some states ban employers from having a “use it or lose it” policy for PTO.

- Unlimited PTO: With unlimited PTO, employers do not have a set number of days and instead let employees take as much time off as they want, within reason. Learn more about unlimited PTO here.

Flexible work schedules

Since the pandemic made remote work boom, flexible work has been a desired, sought-after benefit.

Flexible work doesn’t just mean fully remote work, though. It can also be:

- Hybrid schedules, where employees go into the office a certain number of days a week, or

- Flexible hours, where employees do not have to work consecutive hours and can instead choose which times throughout the day to work.

Although it’s not required – and can be infeasible for some industries – many workers, especially those who realized they can do their best work outside of the office during COVID-19, are unwilling to compromise a flexible schedule, making it a top competitive benefit.

Family and parental leave policies

Support for inclusive, comprehensive family benefits has been a growing trend in the past few years, and is expected to continue trending up in the coming years.

Parental leave – which includes maternal or paternal leave – offers paid or unpaid time off for new parents. In addition to bonding with a new child, this time can be used for caring for a sick child or a pregnancy-related condition.

Although some types of parental leave are optional, others are required by law, such as when the Family and Medical Leave Act (FMLA) applies. Under FMLA, employees of companies that meet certain requirements are eligible for 12 weeks of unpaid leave each year, which can be used for the birth of a child. In addition, pregnancy and childbirth are qualifiers for short-term disability in certain states, and many states offer paid family and medical leave programs.

But parental leave isn’t the only family benefit that companies can offer. Employers can also implement support for caregivers, such as flexible hours or resource assistance.

Childcare assistance

Childcare assistance is another fringe benefit that can support working parents.

There are many different ways that employers can provide childcare support, such as:

- Subsidized or discounted childcare

- On-site daycare centers

- Vouchers or reimbursement for childcare costs, or

- Backup childcare options.

Additionally, many companies are beginning to offer other types of caregiving assistance, such as eldercare assistance, including flexible work schedules, resource assistance and support groups.

Employee discounts and perks

Many employers offer fringe benefits in the form of discounts and perks for various purposes. It can span from wellness discounts like subsidized gym memberships or class passes to commuter benefits like transportation discounts.

Employers may also offer professional development perks like reimbursement for education expenses. Employers can reimburse employees through periodic stipends, bonuses or a structured reimbursement program.

Best practices to consider

Simply providing access to employee benefits is not enough to retain top talent; utilizing best practices ensures that benefits are working for your employees.

Assessing employee needs

The best way to make sure your employee benefits package works for your company is to find out what your employees need and tailor your program to those needs. One of the best ways to do this is to survey your workforce to get feedback and identify any trends in responses.

Additionally, it’s important to take stock of employee demographics to help address diverse workforce needs and implement employee benefits that cater to what they need. For example, if your workforce is primarily Gen Z or millennials, you may consider focusing on employee benefits that cater to younger generations, such as student loan assistance or family planning.

Benchmarking against industry standards

If you want to attract and retain top talent, it’s important to look at employee benefits packages across your industry.

You may want to do research – such as an industry analysis – and compare employee benefits packages for your specific industry. From there, you can pinpoint competitive advantages and areas you can capitalize on, or you may find some gaps in your offerings that you can eliminate to improve attraction and retention.

For example, you may compare your health insurance plan to the scope of competitors, or examine your PTO offerings against industry standards. It’s important to remember that employee benefits packages vary widely depending on what industry you’re in.

Routinely benchmarking employee benefits can ensure you’re keeping up with industry standards and staying competitive.

Understanding ERISA, ACA, and other relevant laws

Because some employee benefits – and benefit stipulations – are required by law, it’s essential to look at the legal side of your benefits and ensure you’re staying compliant. In some cases, it can be helpful to reach out to legal counsel to ensure compliance.

Here are some of the most important federal laws that should be on your radar:

- Employee Retirement Income Security Act of 1974 (ERISA): ERISA is a federal law that sets minimum standards for most private sector retirement and health benefit plans. It aims to protect individuals that participate in these plans by establishing rules for transparency and accountability, such as providing plan information and fiduciary responsibilities.

- Affordable Care Act (ACA): ACA is a health insurance reform law that was established in 2010 to expand health insurance coverage. Under the ACA, certain employers are required to offer health insurance to full-time employees, as well as provide coverage for dependents, among other reformations.

- Family and Medical Leave Act (FMLA): Under FMLA, eligible employees are offered unpaid, job-protected leave for certain family or medical reasons, such as serious illness or childbirth. During this time, employers must continue to provide health insurance coverage and employees can continue to accrue retirement and financial benefits. Find a full list of FMLA laws by state here.

- Americans with Disabilities Act (ADA): ADA prohibits discrimination against individuals with disabilities, and requires employers to provide reasonable accommodations. This can include modifications or adjustments to policies, such as providing additional unpaid time off. Employers should also ensure that other benefit offerings, like life insurance or health insurance, do not discriminate against employees with disabilities.

Some of these laws also have rules around reporting and disclosure. For example, under ERISA, employers must file annual reports with the Department of Labor (DOL), and employers subject to ACA requirements are required to file annual reports regarding health care information for employees.

Failure to comply with these regulations or other applicable regulations – such as non-discrimination rules – can lead to hefty penalties for employers.

Note: These legal requirements can change over time. HR pros should work to stay informed through regular legal reviews, paying attention to government agency updates like the IRS, and routine training and education.

Navigating tax implications

Understanding tax implications of different employee benefits offerings is crucial to ensure that you stay compliant.

Employers can capitalize on tax advantages of certain employee benefits. For example, employer contributions to employee retirement accounts are typically tax-deductible, as well as contributions to health insurance premiums.

For employees, some benefits can be pre-tax to reduce taxable income, such as 401(k) or HSA contributions, as well as health insurance premiums. However, some financial benefits including 401(k) and pension plans have specific IRS guidelines, including contribution limits and vesting schedules, that must be followed. HSAs also have IRS guidelines that must be followed.

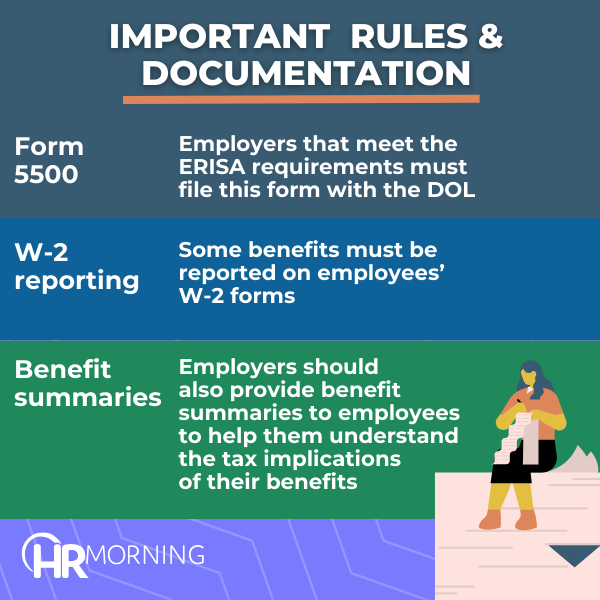

In addition to following set guidelines, employers must also comply with documentation and reporting rules, including:

- Form 5500: Employers that meet the ERISA requirements must file this form with the DOL, which provides information about the financial operations of the plan.

- W-2 reporting: Some benefits, like group life insurance over $50,000, must be reported on employees’ W-2 forms.

- Benefit summaries: Employers should also provide benefit summaries to employees to help them understand the tax implications of their benefits, like pre- and post-tax contributions.

Customizing employee benefits

The best way to ensure that employees get true value from their employee benefits package is to customize benefits to your specific workforce needs.

That doesn’t just mean making sure it aligns with what employees need; your benefits should also be tailored to your company’s culture and values.

For example, placing a strong cultural emphasis on mental health and wellness can be reflected in your benefits plan by making mental health accessible and affordable for all employees through wellness initiatives or comprehensive treatment options.

Offering flexibility in choosing the right employee benefits for individual workers can help improve employee satisfaction and retention. Consider offering a menu of benefits for employees to choose from that are diverse, targeted and high-impact to ensure that employees gain value from their benefits.

Bottom line

No matter what type of employee benefits you offer, it’s important to continually interact with employees to make sure that they’re right for your workforce.

Employee benefits that aren’t being used or are low-value can mean wasted money, time and effort for both you and your employees, so taking the time to understand what your employees need and how to best deliver it to them is crucial.