2021: New IRS dollar limits for 401(k)s, HSAs, FSAs, HRAs

2021 dollar limits on health savings accounts and retirement accounts

Get access to 100's of HR resources in HRM INSIDER

Learn More2021 dollar limits on health savings accounts and retirement accounts

When was the last time your employees were pleasantly surprised by their healthcare benefits like health savings accounts (HSAs)? It’s safe to say that when it comes to their covered benefits, employees hope for reliable coverage and security for their personal needs and those of their dependents, reasonable premiums and minimal administrative hassle. That’s not…

The greatest benefit for the millennial generation is an HSA’s “triple tax savings,” combined with how time can amplify those savings to grow an individual’s account.

Here’s something you probably haven’t heard about healthcare reform: It’ll significantly affect your company’s payroll operations.

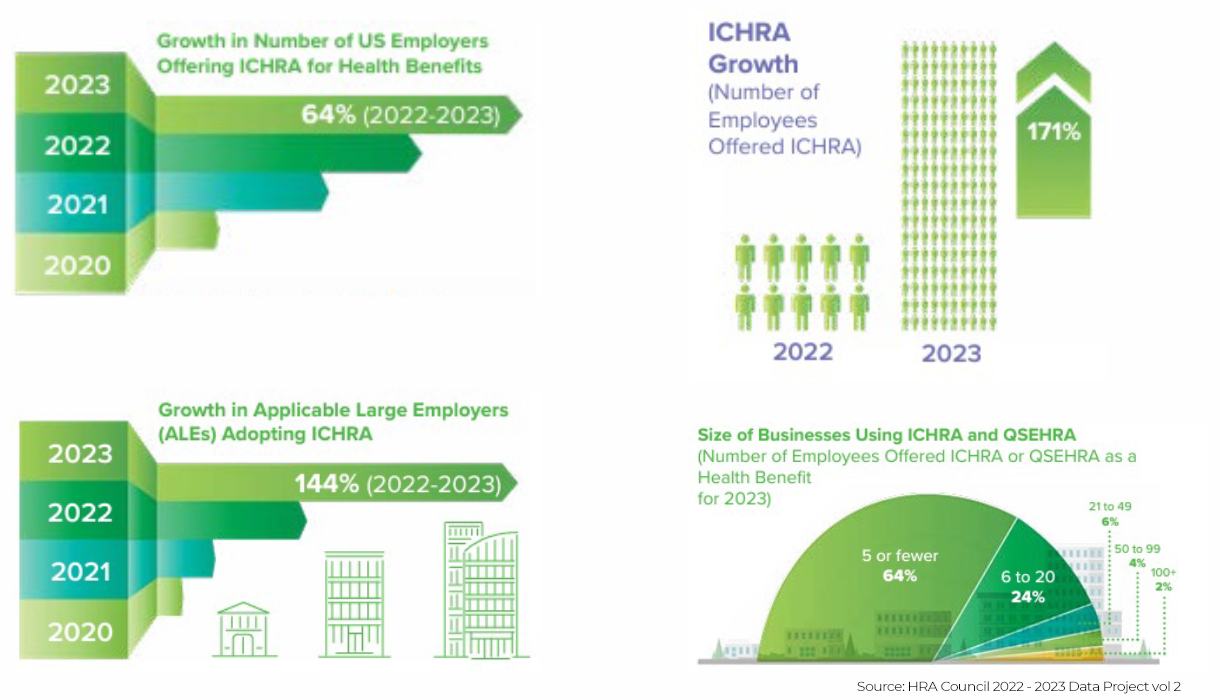

In recent years, the world of employee benefits and health insurance has undergone a seismic shift, reflecting broader changes in the needs and expectations of the modern workforce, and impacting employer strategies as they compete to attract and retain talent. In the past decade, health insurance costs have skyrocketed with the average employee contribution to…

With tax season in full swing, your employees may be sifting through shoeboxes full of receipts in an attempt to identify and organize qualified health savings account (HSA) expenses as part of their 2022 tax filing. But the more likely scenario is they’re completely unaware of the need to verify HSA purchases. The ability to…

The health reform law has been in place long enough for employers’ compliance efforts to lose some steam. But complacency is leaving many firms wide open to problems.

Offering the right benefits involves a lot of decision-making and can be challenging for many employers: How do you give employees the coverage they need without breaking the budget? Two pre-tax accounts make the decision easy: Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs). But what’s the difference between FSAs and HSAs? Knowing the…

Employers have one more week to make sure they’re in compliance with the new restrictions on health reimbursement accounts (HRAs) and flexible spending accounts (FSAs).

We all strive to lead healthy lives, but illnesses and accidents are inevitable, no matter how cautious we are. Health Savings Accounts (HSAs) are a great way to help employees protect themselves financially. Offering an HSA to your employees can help them take control of their health and prepare for retirement. However, HSAs can be…

In today’s rapidly evolving healthcare landscape, Health Savings Accounts (HSAs) offer a remarkably effective solution to ease the financial strain experienced by employees due to high inflation and the changing nature of health insurance. But employees — and often employers — have legitimate questions about HSAs. Are you prepared to answer them? HSAs, when paired…

Our HR editorials undergo rigorous vetting by HR and legal experts, ensuring accuracy and compliance with relevant laws. With over two decades of combined experience in Human Resources thought leadership, our editorial team offers profound insights and practical solutions to real-world HR challenges. This expertise not only enhances the credibility of our content but also makes HRMorning a dependable resource.

For more information, read our editorial policy.

We ask for your credit card to allow your subscription to continue should you decide to keep your membership beyond the free trial period. This prevents any interruption of content access.

Your card will not be charged at any point during your 21 day free trial

and you may cancel at any time during your free trial.